The Work Opportunity Tax Credit (WOTC) is a federal income tax credit incentive provided to private sector employers. An employer may be eligible for WOTC when they hire from certain target groups of job seekers who face employment barriers. The WOTC tax credit is a one-time tax credit for each new hire - and there is no limit to the number of new hires who can qualify an employer for a tax credit. The requirements for this program are set by the Internal Revenue Service and the U.S. Department of Labor, Employment and Training Administration.

The Work Opportunity Tax Credit (WOTC) is a federal income tax credit incentive provided to private sector employers. An employer may be eligible for WOTC when they hire from certain target groups of job seekers who face employment barriers. The WOTC tax credit is a one-time tax credit for each new hire - and there is no limit to the number of new hires who can qualify an employer for a tax credit. The requirements for this program are set by the Internal Revenue Service and the U.S. Department of Labor, Employment and Training Administration.

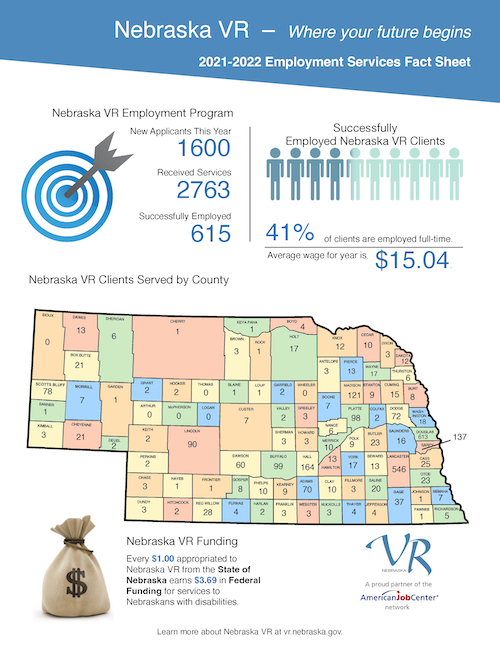

Employers that hire Nebraska VR's qualified candidates may claim the WOTC. Nebraska VR's Employment Specialists will access our candidate pool to find individuals with skills for your specific job openings.

To qualify for the credit, employers must file within 28 calendar days of the employee hire date, including weekends and holidays.

Follow the steps outlined in the Nebraska Department of Labor Guidance Letter to get started.

Use the Department of Labor's dedicated WOTC email address for requesting answers to questions or for additional assistance if needed: WOTCHelp@nebraska.gov. Email is monitored daily by a DOL WOTC expert.

Two other tax credits available in addition to the WOTC.

More information from the IRS: Tax Benefits for Businesses Who Have Employees with Disabilities

The Pathway to Employment Video Series is designed to de-mystify the many services provided to clients and businesses while highlighting the innovation that is the culture of Nebraska VR. While certainly each story is either one of progress towards an employment goal or a client's employment goal success, they are also stories about the important role played by staff members, businesses, ATP, Easter Seals, Project SEARCH, and others. Go to: vr.nebraska.gov/videos/